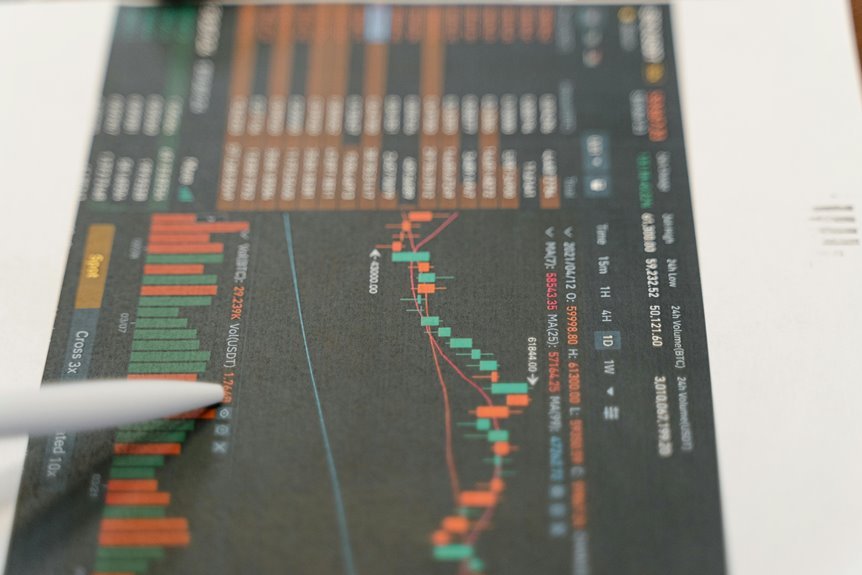

The Market Trends and Indicators Digest provides a structured examination of critical economic indicators, including 768610000, 3496565769, 944007115, and 918783242. These indicators reflect the complex interplay of market volatility, consumer sentiment, and employment trends. Stakeholders must remain vigilant to adapt to shifting economic landscapes. The implications of these trends on investment strategies warrant careful consideration. Understanding the nuances of each indicator can reveal deeper insights into market dynamics.

Overview of Market Indicator 768610000

Market Indicator 768610000 serves as a critical benchmark in evaluating economic trends and investment conditions.

Its significance lies in its ability to reflect the economic impact of market volatility, allowing investors to make informed decisions.

Analysis of Market Indicator 3496565769

Following the insights offered by Market Indicator 768610000, the analysis of Market Indicator 3496565769 provides an additional layer of understanding regarding economic dynamics.

This indicator reveals significant correlations between market volatility and its broader economic impact, emphasizing the necessity for stakeholders to adapt strategies accordingly.

Insights From Market Indicator 944007115

Economic indicators serve as critical tools for understanding market behaviors, and insights from Market Indicator 944007115 offer valuable perspectives on consumer sentiment and spending patterns.

This indicator reveals significant economic signals regarding market fluctuations, highlighting shifts in consumer confidence and purchasing trends. Analysts interpret these insights to forecast potential economic conditions, thereby enabling stakeholders to make informed decisions in an unpredictable market landscape.

Trends Associated With Market Indicator 918783242

Trends associated with Market Indicator 918783242 provide a comprehensive view of the current economic landscape, particularly in relation to employment rates and wage growth.

Recent analysis suggests that market shifts are increasingly influencing economic forecasts, indicating potential volatility. As businesses adapt to changing conditions, labor market dynamics reflect broader economic realities, shaping opportunities for job seekers and impacting wage trends significantly.

Conclusion

In juxtaposing the varied market indicators, a complex narrative unfolds: while Indicator 768610000 suggests resilience amidst volatility, Indicator 3496565769 reveals lurking uncertainties that threaten consumer confidence. Simultaneously, Indicator 944007115 highlights a buoyant labor market, contrasting sharply with the cautionary notes of Indicator 918783242, which reflects the fragility of economic recovery. This intricate interplay underscores the necessity for stakeholders to remain vigilant, as the delicate balance between optimism and caution shapes the future of investment landscapes.